Orient Technologies IPO opens for subscription

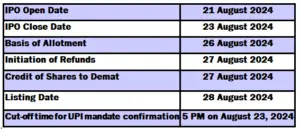

Orient Technologies IPO opens for subscription on August 21, 2024 and closes on August 23, 2024. Allotment for Orient Technologies IPO is expected to be finalized on Monday, August 26, 2024. Orient Technologies IPO will be provisionally listed on BSE, NSE. Listing date set for Wednesday, August 28, 2024.

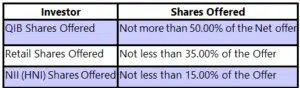

Orient Technologies IPO is a book built issue of Rs 214.76 crore. The issue is a combination of fresh issue of 58 lakh shares, totaling Rs 120.00 crore and offer for sale of 46 lakh shares, totaling Rs 94.76 crore.

Orient Technologies ltd IPO Timeline :

Orient Technologies IPO opens on August 21, 2024, and closes on August 23, 2024.

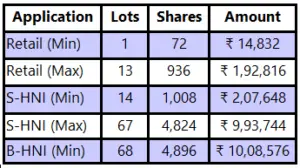

Orient Technologies IPO Lot Size :

Investors can bid for a minimum of 72 shares and in multiples therein. The table below depicts the minimum and maximum investment by retail investors and HNIs in terms of shares and amount.

Orient Technologies IPO Reservation :

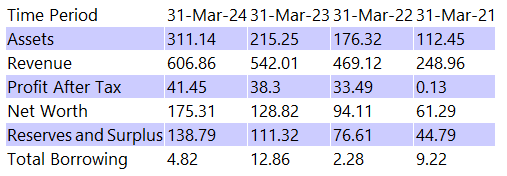

Orient Technologies Limited Financial Status :

About Orient Technologies Limited

Orient Technologies Ltd was founded on July 4, 1997 in Mumbai, India. The company specializes in providing a wide range of IT services and solutions, including systems integration, IT infrastructure management, and IT consulting.

In addition, Orient Technologies offers a wide range of hardware and software products, designed to meet the technology requirements of various industries. Their solutions are aimed at optimizing the IT environment, which enhances operational efficiency and supports business growth.

With a strong focus on innovation and customer-centric services, Orient Technologies has built a reputation for providing tailored IT solutions that drive digital transformation for its clients. The company’s offerings are particularly valued by organizations that want to streamline their IT processes and adopt cutting-edge technologies that give them a competitive edge in the marketplace.

Orient Technologies Ltd Contact Details : Orient Technologies Limited Off No-502, 5th Floor, Akruti Star, Central Road, MIDC, Opp. Akruti Point Central Andheri (East), Mumbai – 400093

Phone: +91 22-4292-8777

Email: complianceofficer@orientindia.net

Website: https://www.orientindia.in/

Elara Capital (India) Private LTD. is the book running lead manager of the Orient Technologies Ltd IPO, while Link Intime India Private Ltd is the registrar for the issue.

Refer to Orient Technologies ltd IPO RHP for detailed information.

India to remain one of the fastest growing economies amid global slowdowns

8.0%

6.0%

4.0%

2.0%

0.0%-2.0%-4.0%-6.0%

Following the recovery from the COVID-19 pandemic, India exhibited a faster growth rate of 7.0% in fiscal 2023, surpassing

both advanced economies at 2.6% and emerging market and developing economies at 4.1%. This trend is expected to continue,

with India leading the growth compared to its counterparts mentioned before.

Global GDP is estimated to grow at 3.2% in CY24 and CY25 amid moderating inflation and steady growth in key

economies

Balance Sheet

Particulars —Mar-21— Mar-22— Mar-23

Equity and Liabilities

Share Capital — 16.5— 17.5— 17.5

Total Reserves — 44.79— 76.61— 111.32

Borrowings —2.28— 1.83— 4.37

Other N/C liabilities— 3.22— 3.76— 9.45

Current liabilities — 62.63— 92.8— 97.3

Total Liabilities— 129.42— 192.49— 239.94

Assets

Net Block— 10.2— 10.45— 19.28

Capital WIP— 0— 0— 0

Intangible WIP — 0— 0— 0

Investments — 0.58— 0.02— 0.2

Loans & Advances— 0.53— 0.29— 0.84

Other N/C Assets— 5.67— 5.42— 4.37

Current Assets —112.45— 176.32 215.25

Total Assets — 129.42— 192.49— 239.94

Orient Technologies ltd Strong Partnerships with Leading Tech Giants

Orient Technologies has forged strategic alliances with major technology players such as Dell, Fortinet, and Nutanix. These partnerships enhance Orient’s ability to innovate and customize products, providing clients with tailor-made solutions that meet specific industry needs. This collaborative approach strengths Orient’s market position and gives it a competitive edge in delivering high-quality, specialized IT services.

Disclaimer:

The views and investment tips expressed by investment experts/broking houses/rating agencies on thekssnews.com are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Thekssnews.com or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.